3 things FDIs cash flow teaches us

- Vishal Das

- Jul 4, 2024

- 1 min read

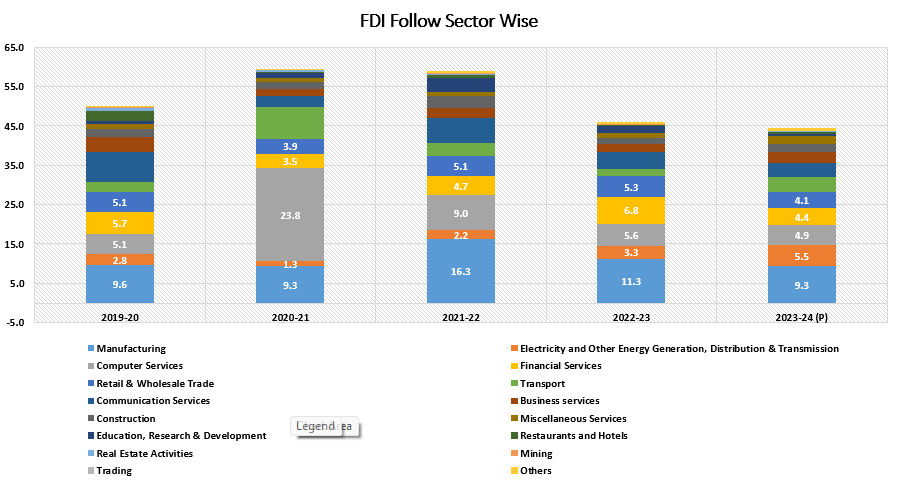

Values are in USD billions.

The FDIs Cashflow are reduced as compared to last year, As projected by RBI as on May 30, 2024.

Top Country to Fund India isn't USA but Singapore, Mauritius then US followed by Netherlands, Japan and so on.

So, here's the deal: who's winning the money marathon race in the world of FDIs?

Let's zoom in and see which sectors are receiving those sweet, sweet funds?

That's the million-dollar question!

These are the Sectors receiving maximum FDIs Cash inflow in descending order:

Manufacturing

Electricity & other Energy Generation, Distribution & transmission

Computer Services

Financial Services

Retail & Wholesale Trade

Transport

Communication Services

Certain principles remain unchanged, much like the sunrise after a long night—constant and unchanging. So do Investing, but people want shortcuts that's why there are hot stocks, top gainers, top loser, experts in news channels, telegram channels, YouTubers, influencers, what not!

just to persuade retail investors to buy rotten tomatoes (useless Assets), who needs that?

Always buy non-cyclical business if you don't understand the manipulation done by companies on annual reports to make sure stock prices doesn't fall.

Don't follow my views, at least start doubting others.

Komentar